Zavvis AI

Finance AI, B2B

Product Design

Web

How I designed an AI-powered co-pilot to help small business owners "speak finance" without a degree.

Year

Aug 2024 – Jan 2025

Role

AI Product Designer

The Problem Space

"I don’t know what my business is worth, and I can’t afford to guess."

Small business owners are experts at their craft, but often "financially blind" when it comes to the big picture.

The Data Gap: 65% of users had never formally valued their business.

The Jargon Barrier: Terms like "Burn Rate" and "KPI Variance" created a wall of anxiety.

The Resource Constraint: Most SMBs can't afford a $200k/year CFO to guide them.

The Challenge: How might we make financial mentorship accessible, actionable, and dare I say…human?

The Discovery

Learning from the Market to Build a Smarter MVP

I analyzed the landscape (Mint, QuickBooks, FinDash) and realized most tools were either too personal (budgeting apps) or too complex (accounting software). None focused on the Founder-to-Investor pipeline.

Key Insight: Users didn't just want a calculator; they wanted a mentor. They needed a tool that didn't just show them a "High Burn Rate" but explained why it was happening and how to fix it.

THE STRATEGY

Making "Smart" Feel "Simple"

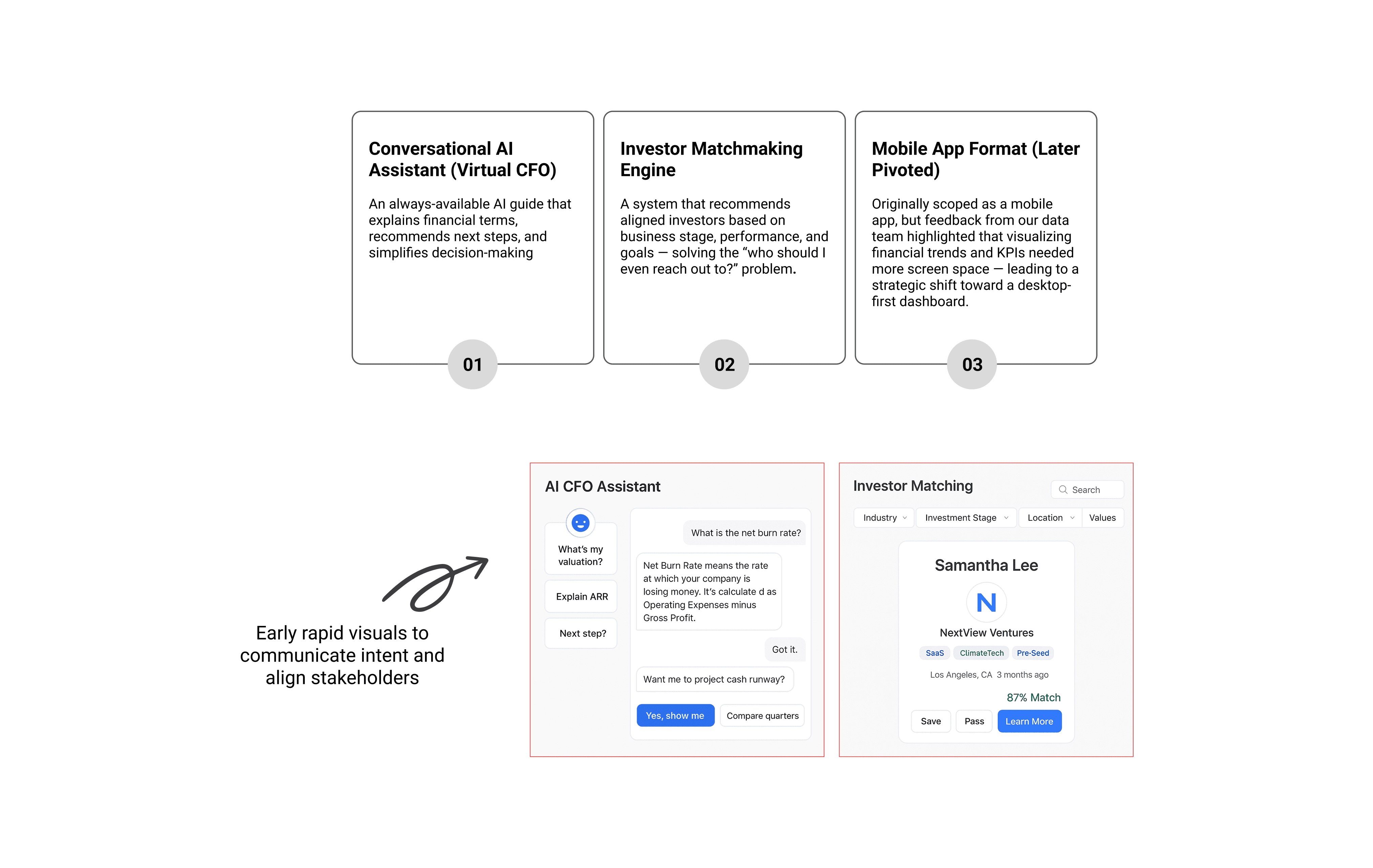

We pivoted from a mobile-first approach to a Desktop-First Dashboard. Why? Because financial strategy requires "deep work" space. You can't plan a Series A funding round on a 6-inch screen.

The Mental Model Shift

I structured the Information Architecture (IA) to follow a founder's natural internal monologue:

"How am I doing?" (Real-time Dashboard)

"What am I worth?" (AI Valuation)

"Who will fund me?" (Investor Matching)

"Wait, what does this mean?" (Conversational AI Assistant)

THE SOLUTION

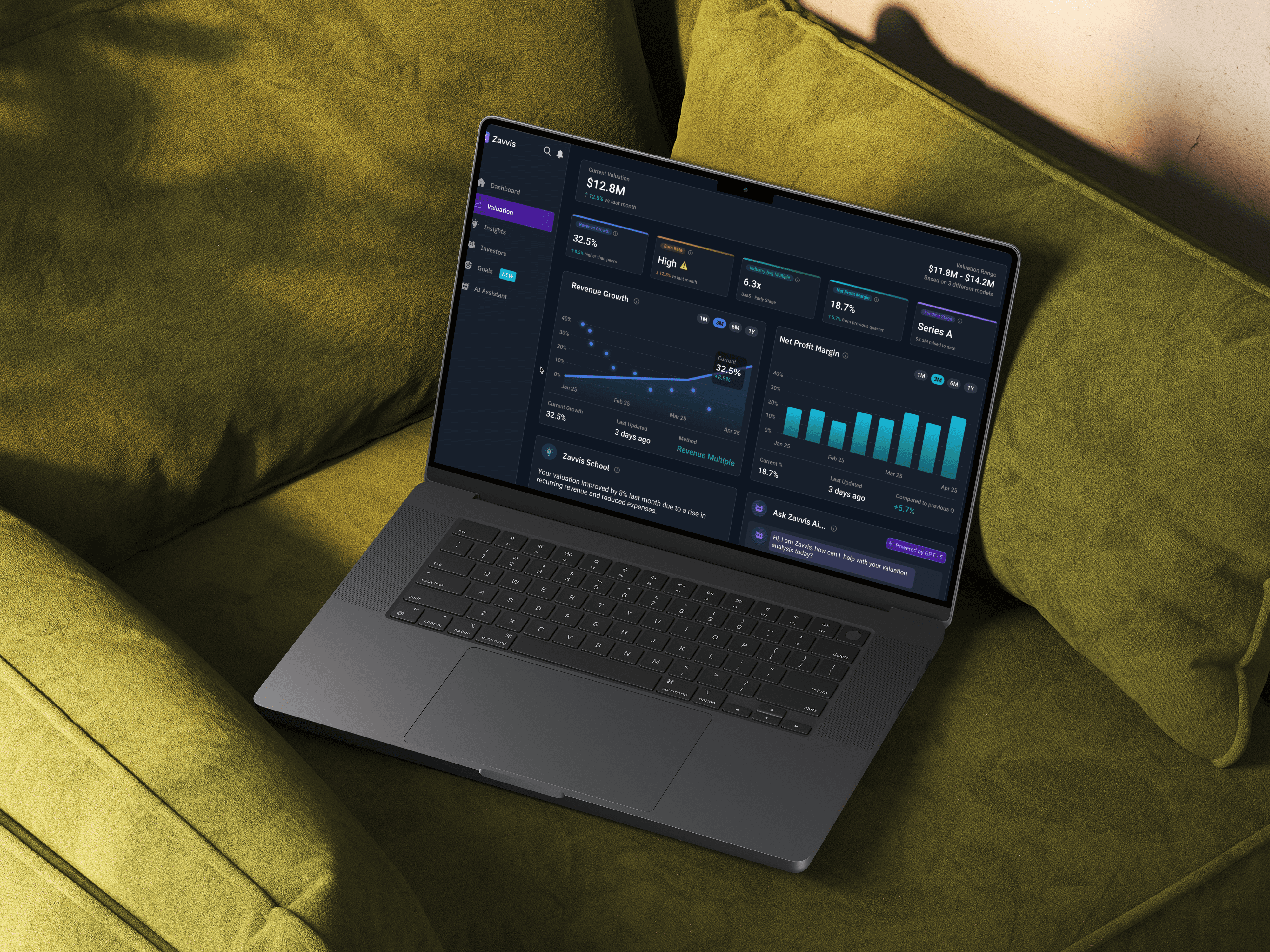

The Interactive Dashboard: "Clarity at a Glance"

I designed a clean, high-signal UI that prioritizes 4 core KPIs. I used visual cues (like the ⚠️ for high burn rates) to provide instant "financial health" checks without requiring the user to crunch numbers.

AI-Powered Valuation & Investor Matching

We removed the "cold outreach" friction. By mapping company data against industry benchmarks, the AI suggests specific investors (e.g., Sequoia, A16z) based on a 92% Match Score. This turned a month-long research task into a 5-minute browse.

The "Persistent" AI Assistant (The Virtual CFO)

The Design Pivot: Originally a floating bubble, I moved the AI into a Dedicated Chat Tab.

Why? Drawing inspiration from ChatGPT and Perplexity, I realized users treat AI as a knowledge repository.They need to save threads, revisit strategy sessions, and document their growth journey.

The Process: Collaboration & Iteration

I didn't design this in a vacuum. I facilitated:

Card Sorting: Clustering raw ideas from founders and engineers to find the "soul" of the MVP.

Weekly Data Analysis Audits: Working with our data analyst to ensure that financial clarity was inclusive for all users, regardless of visual or cognitive needs.

The Result & Reflection

Zavvis AI became more than a tool; it became a pitch asset. We successfully created a "Smart MVP" that made finance feel like a conversation rather than a math test.

Key Takeaway: In AI design, the goal isn't just to show data—it's to provide context. A dashboard tells you whathappened; a great AI product tells you what to do next.